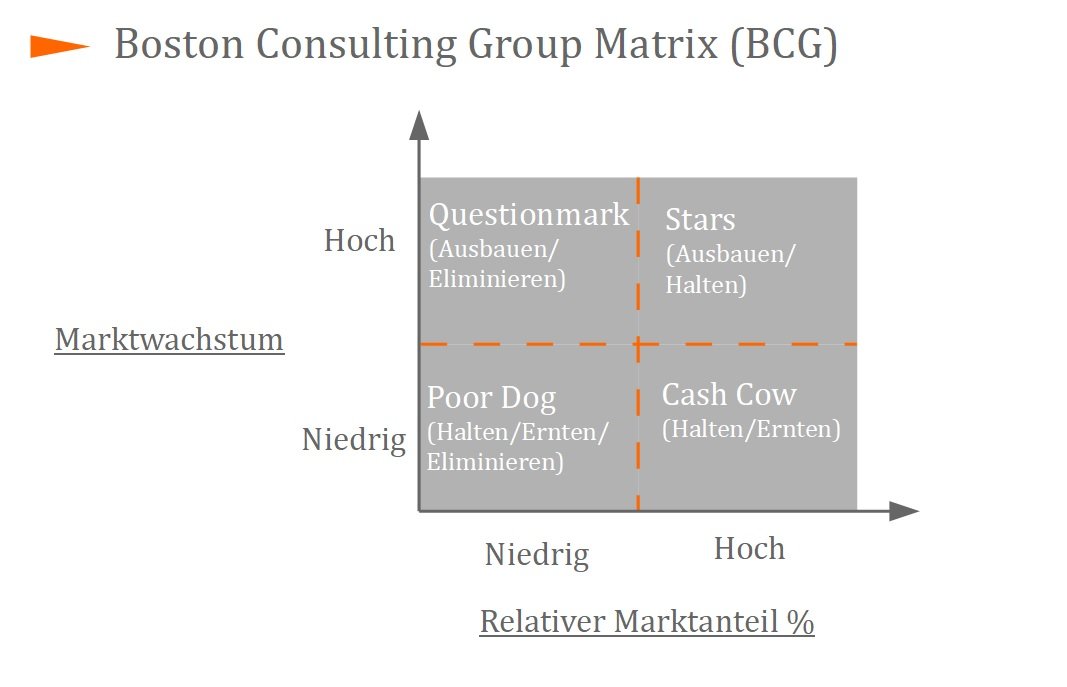

Pets are products you can often discard because they drain resources you can use to invest in your other products. You can invest or discard them on a product-by-product basis because each one is different and may have more resources needed to put it into the Star category. Question Marks are products that have the potential to become Stars.

Cash Cows are products you can keep because they create a lot of profit, but you can divert funding away from them because they are in a market that doesn't grow as quickly. Stars are excellent products to invest in because they have a lot of value due to the market they are in and are likely to continue generating increasing value because of their high growth. Pets are products that have a low growth rate and a low market share.Ĭash Cows are products that have a low growth rate but a high market share. Question Marks are products that have a high growth rate but a low market share. Stars are products that have a high growth rate and a high market share. Each category represents a particular type of product: You can use a BCG matrix to gain a better understanding of your products by grouping them into the four categories the table provides. Related: A Complete Guide to Project Management Ways to use a BCG matrixīelow are two ways that you can use a BCG matrix to increase the value of your financial portfolio: Using a BCG matrix for product strategy The horizontal axis representing market share is the portion of an area where you conduct commercial deals that you control. The vertical axis representing growth is the amount of potential a product has to bring in money. You can write a BCG matrix as a table that is divided into four parts, each of which represents a particular product or business, with a vertical axis that represents growth and a horizontal axis that represents market share. It is a framework for portfolio management that allows you to prioritize different products. The BCG matrix, also known as a growth/share matrix, is a business tool that you can use to help you create strategic, long-term plans regarding investment in competitiveness and market attractiveness. Related: Guide to Project Portfolio Management What is the BCG matrix? In this article, we discuss what a BCG matrix is, ways you can use it, tips to help you create one and two examples of what a BCG matrix looks like. Knowing what a BCG matrix is and how to use one can help you make sound financial decisions. One way to predict outcomes is through analyzing product strategy and marketing channels.Ī popular method is the Boston Consulting Group, or BCG, matrix. Predicting the outcome of a financial portfolio accurately is an important skill for financial analysts, business owners and other people who work in the financial sector.

0 kommentar(er)

0 kommentar(er)